Auto shut-off dispensing tap

Safety, Health and Environmental (SHE) control

ISO 4406 - the cleanliness code explained

Oil Contamination problems

What is Viscosity?

Three-way filtration

What is Wear?

ISO 460

[...]

Return on Investment (ROI) is a financial metric used to evaluate the profitability or efficiency of an investment relative to its cost. It's a fundamental measure in finance and business decision-making, providing insight into the potential gains or losses generated from an investment.

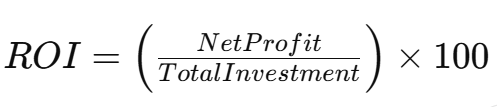

The ROI formula is simple:

Where:

Net Profit is the total gain from the investment minus the total cost.

Total Investment is the initial cost of the investment.

ROI provides a quantitative measure of investment performance, enabling stakeholders to make informed decisions, allocate resources efficiently, and maximize returns in both financial and strategic contexts.